Once you establish a cellular purse (or several of them) on your unit, you’re happy to generate payments. If you want to earn significantly more than step one% if you are paying their mobile expenses that have a credit card, your best option is just one of the cards above. Extended warranty runs the newest manufacturer’s assurance to the qualified items. They mirrors the brand new maker’s security, and therefore the fresh publicity details will vary from buy to buy. When you’re warranty will take care of your own portable in case your issuer listings it a qualified pick, it can simply protection your for a particular time period. In contrast, smartphone shelter could be offered if you shell out your own statement with your card every month.

Security: Would it be Secure?

Designed for iphone and you can Android os, Venmo is currently in the minimal launch, so that you’ll have to register to your application’s prepared number to test it. It lets family receive and send repayments no exchange costs otherwise join costs. (Or even better, do they owe you?) Transferring dollars between two different people is easy, and a lot of apps makes it possible to perform the task. Indeed, if you any on the web banking from the cell phone, you can even curently have the new application you want. For those who hook up Venmo with your debit cards otherwise checking account, all the transfers are completely totally free.

How do i pay which have cryptocurrency if i just have Bitcoin?

One two different people that have PayPal accounts is also posting personal payments anywhere between themselves with no exchange charges, as long as the newest costs are produced from a linked examining membership (rather than a credit card). An electronic purse is different from playing with an equal-to-peer (P2P) commission software such as Venmo or Zelle. Those applications allows you to send somebody currency, nevertheless app isn’t constantly kept in their digital handbag. An electronic digital bag is a virtual location to shop information about your own payment actions. For example, the digital purse you are going to tend to be details about handmade cards and financial account. It could include digital “cards” with your resorts advantages amounts otherwise your own Starbucks cards.

According to the smart phone you utilize, there are a few common sort of electronic wallets to select from. In spite of the term, Samsung Shell out deals with one progressive Android cellular telephone, however, that it access doesn’t convert in order to smartwatches, as the system only operates on the all brand name’s own Universe range. If this’s time for you spend, simply discover your own cellular telephone with your form of alternatives (fingerprint, deal with, or PIN), and then hold your device up against the terminal to use your own cards. For many who’re using a great WearOS view, you’ll need install the fresh Bing Pay software on the cell phone, next utilize the observe program to select one of many cards you’ve install. The applying is beneficial for students, experts, small business owners and you can people enduring loans.

If you’d like something entirely private, I’d recommend provide notes otherwise prepaid service debit notes rather. An e-bag (or electronic handbag) is the most smoother way to store online that have limited privacy. Very e-wallets, such PayPal, Bucks Application, and Venmo, allow you to manage a mrbetlogin.com visit the site pseudonym (a fake label otherwise moniker) that can are available in place of your genuine name after you make a purchase. Certainly one of apartment-rates dollars-right back cards, you will end up difficult-forced to beat the brand new Wells Fargo Active Cash Card. And, the fresh cards now offers a rich indication-upwards incentive and you may a great introduction Apr period on the both sales and transfers of balance.

Chances are, you may have heard about Android os Shell out, Fruit Spend, and even Samsung Shell out, but you most likely wear’t make use of them all of that have a tendency to — if. They all work with basically the same manner; because the head alternatives to suit your debit otherwise credit cards from the individuals stores such as Starbucks or Entire Foods. An average Western spends over 3 ½ occasions on their cellular phone every day.

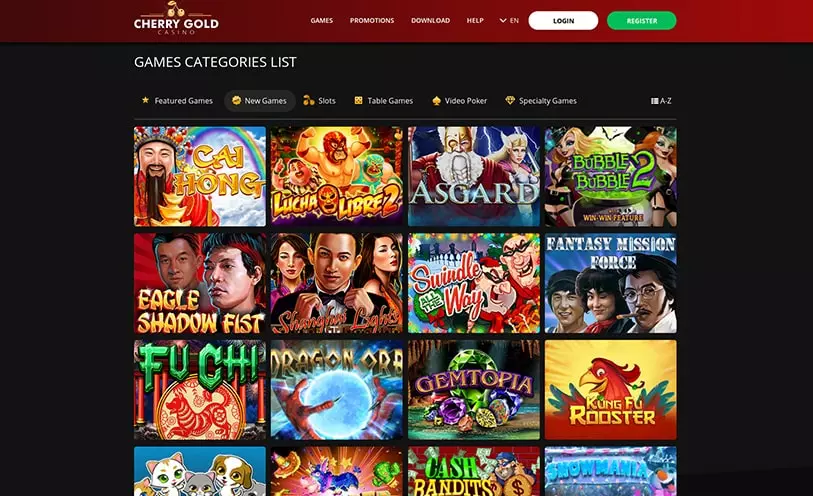

The application form allows you to shop multiple notes also to put the standard percentage strategy. Your own Electronic Wallet can be’t be used to have a payment as opposed to the verification. There are a few web based casinos available to All of us owners one encourage smartphone costs to own places. 3rd party processors including Boku and Payforit are growing the areas and also have associated with gambling enterprises aimed at All of us professionals.

Yet not, the overall techniques in depth more than is always to give you a great expertise away from how to make an installment using your mobile. Your financial business’s on the web financial webpages can get enables you to publish currency in order to another person having a Canadian family savings. Very cellular phone services give a variety of intends to choose from, and you will switch to another package when. For individuals who’lso are unclear and that plan suits you, you might contact your cellular phone company to own assist. They can opinion the usage and you may suggest an agenda that suits your needs. This article will briefly discuss the finest 15 contactless commission programs centered on ratings from credible other sites.

PayPal operates while the one another an electronic digital wallet and you can a separate commission strategy, making it possible for versatile payment alternatives, in addition to bank account payments, e-checks and you may credit cards. PayPal is commonly approved by online shops while offering strong scam prevention procedures to protect their painful and sensitive advice. Keep in mind that exchange charges get pertain which have certain PayPal functions. Whenever considering having PayPal, you should use a few fee actions as well as debit cards, playing cards, prepaid service cards, otherwise bank account out of your handbag—and you can employ exactly how much you desire used on per. As well as getting the better-dependent identity within the on the internet money, PayPal supplies the most-state-of-the-art choices for people-to-people portable money.

The beauty of within the-store costs which have PayPal is the fact that application is actually recognized during the lots of places that you may not really expect, and also the software can reveal just what regional stores capture the new PayPal software to possess money. When you tap the fresh “Waiting for you” symbol you’ll be given a listing of resellers close by. You could be aware of the term PayPal from its personal links in order to e-bay, exactly what you do not discover is that PayPal currently features a cellular payment service installed and operating, with a rather good character as well. Only download the fresh application, check in with your PayPal account information otherwise install a the brand new membership, and you will faucet “In store” on the household screen.

Render to manage management employment for example fixing asking problems otherwise disputing costs if needed. When assisting seniors particularly, imagine setting up automatic monthly payments through the service provider. One another allows you to pay the bill because the a present while you are keeping your involvement unknown when the desired. Merely recognize the brand new fee may not procedure right away for example a great regular on the internet percentage. New iphone 4 uses fingerprint detection so you can finalise for every Fruit Pay commission, causing the brand new already-safe NFC technology.

- It’s not the fastest services and it’s likely to all troubles regular post face (package theft, delivering destroyed/defer, an such like.), nonetheless it performs.

- Klarna enables you to split orders for the four money any kind of time on line store — not just Klarna locations — when you shop your favorite other sites through the Klarna app.

- Depending on the smart phone you employ, there are a few common form of electronic wallets to pick from.

- A lot of people fool around with peer-to-peer fee programs for example Zelle, Venmo and cash App in order to easily publish money in order to loved ones and you can loved ones.

The newest downside is that Prism isn’t establish to cope with your powering expenditures otherwise download your bank account information. An unknown commission strategy results in your individually identifiable suggestions isn’t visually noticeable to people active in the exchange — specifically the merchant or individual. Thus after you make a purchase, owner never come across information just like your name, address, otherwise fee cards number.

The brand new ecosystem away from cellular fee software All of the apps try thorough, allowing for a simple solution designed to each and every associate and lender. As opposed to NFC on your cellular phone, you’ll not have the ability to make contactless repayments in stores, though there are other cellular payment options one we’ll discuss later on. When you pay because of the mobile phone, you generally unlock your own electronic handbag and choose which way of use—exactly as you would a timeless handbag. You merely use your cellular phone’s cam to add your own commitment or provide cards as well since the credit cards. After they’lso are piled, you can check out about anywhere borrowing from the bank or debit notes are approved.

Recent Comments