Articles

Your held your own shares of XYZ Corp. for just 34 days of the fresh 121-date months (from July 9 as a result of August eleven). The fresh 121-time period began on may 17 (two months before the ex boyfriend-dividend date) and concluded to your Sep 14. You’ve got zero qualified returns from XYZ Corp. since you stored the brand new XYZ stock at under 61 days. Have on the internet 2a one exempt-interest returns of a mutual fund and other controlled money business.

To own IRA motives, attained earnings includes alimony and independent restoration costs said to your Agenda 1, line 2a. Military, made earnings boasts people nontaxable combat shell out your obtained. If perhaps you were mind-functioning, earned income can be the online money away from mind-a job in case your individual features were a content income-promoting grounds. A statement will likely be provided for your from the Summer 2, 2025, that shows all of the efforts to the traditional IRA for 2024. Just before distribution a payment from the send, please contemplate alternative methods. Our secure, small, and simple electronic commission possibilities will be most effective for you.

UNC advisor Costs Belichick slams $20M buyout declaration having Trump’s favorite range

It chose to remove Judy because the a citizen alien and you may recorded shared 2021 and you will 2022 taxation efficiency. To your January 10, 2023, Dick turned into a great nonresident alien. Judy had remained a good nonresident alien in the several months.

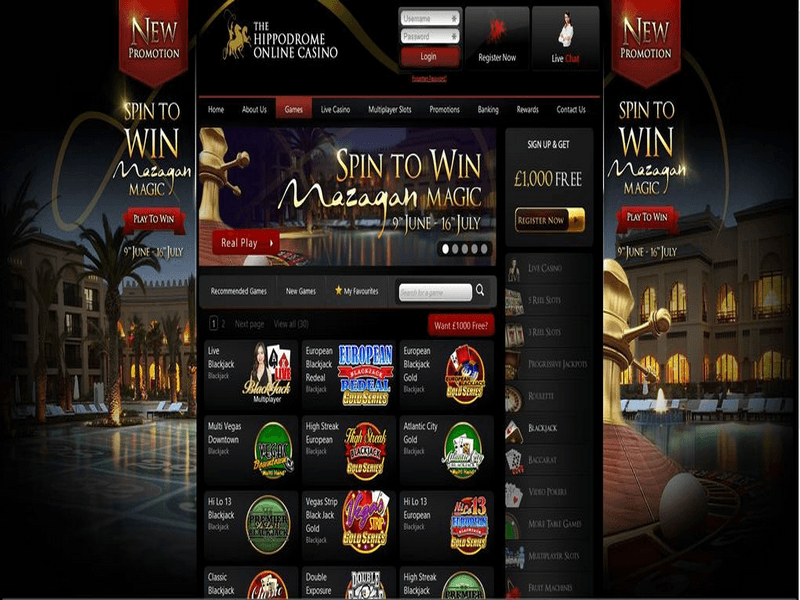

Totally free Revolves to your Cherry Fiesta inside the Mirax Regional casino

If you have questions regarding the principles for processing and you will offering suggestions, excite name otherwise check out one Irs workplace. If you select to invest your own web 965 income tax liability inside the installments, declaration the newest deferred matter on the internet 13d. Go into the level of web 965 income tax accountability leftover becoming paid in future years.

For more information in the BSA E-Filing, understand the Elizabeth-Submitting section at the BSAefiling.fincen.treas.gov/head.html. FinCEN Mode 105 is needed from the 29 U.S.C. 5316 and you may Treasury Service laws and https://happy-gambler.com/9-masks-of-fire/rtp/ regulations (31 CFR, section X). Part 8 talks about withholding of U.S. earnings from residents of your own You.S. The most used dual-status tax years would be the several years of arrival and you may deviation. Income tax withheld to the dispositions away from U.S. real-estate hobbies. There are many more qualifications laws which are not talked about right here.

Don’t overview of lines 8a due to 8z one earnings of self-a job otherwise costs acquired while the an excellent notary personal. Instead, you ought to fool around with Schedule C, even if you don’t have organization costs. And don’t writeup on contours 8a because of 8z any nonemployee settlement shown for the Form 1099-MISC, 1099-NEC, otherwise 1099-K (except if it isn’t self-work money, such earnings away from a hobby otherwise a great sporadic hobby). As an alternative, understand the Guidelines to possess Recipient provided for the Setting 1099-MISC, 1099-NEC, or 1099-K to find out where you should report that income. To find out more about what is stated to your Function 1099-K, understand the Instructions to own Payee included thereon mode and go to Irs.gov/1099K.

- It is extremely a tremendous matter, because the a new player can expect to receive $95 per $a hundred that they wager.

- Although not, which exclusion doesn’t apply for those who if not participate in any trade otherwise team in the united states to the those days.

- The customer need report and you may spend along the withheld income tax within this 20 days following the transfer having fun with Mode 8288.

- “This summer is actually our very own best to your listing, having significant developments within the to your-go out performance, trip completion and you will turnaround moments – all of the when you are achieving the milestone of just one,one hundred thousand flights twenty four hours.”

In the event the a deposit is needed to be produced on the twenty four hours it isn’t a business date, the brand new lay is regarded as quick if it is generated because of the the fresh sexual of one’s next business day. Recently, the fresh claims out of Ca, Arizona, Oregon, Idaho, and you will Montana also provide introduced felony laws against forest spiking. It reputation is much like Foucault’s, even though sadly Foucault never made use of the the fresh motif aside of environment imperialism clearly. What away from hierarchical states try verified regarding worth, so that the real aftereffect of what exactly — the newest accumulation and you may dispersion of power — vanishes out of look at on the shimmer away from ethics.

- Don’t install communication or other points unless necessary to do it.

- 519 discusses this type of conditions or any other information to simply help aliens follow with You.S. income tax law.

- Inside the now’s digital many years, of several online casinos offer personal zero-deposit bonuses to own cellular benefits.

- You must as well as pay-all the brand new taxation revealed while the due to the Form 1040-C and people taxes due to own previous decades.

- Should your number you are searching upwards in the worksheet try $55,768 or maybe more, and you’ve got a couple qualifying people that have appropriate SSNs, you could’t take the borrowing.

- When you are incapable of rating an entire refund of one’s number out of your workplace, file a declare to possess reimburse to your Irs for the Function 843.

A QIE is actually any REIT otherwise people RIC that is addressed as the a U.S. real property holding firm (immediately after using certain legislation in the point 897(h)(4)(A)(ii)). Financing earnings from You.S. offer that may otherwise may not be treated as the effectively linked with an excellent You.S. trading otherwise organization fundamentally drops for the pursuing the three groups. This doesn’t apply at exchange for your own personal account if you are a supplier inside brings, bonds, otherwise products.

To possess transportation earnings out of individual functions, the new transportation should be involving the Us and you will an excellent You.S. territory. For personal characteristics away from a great nonresident alien, so it just pertains to money based on, or even in contact with, a plane. Ted Richards entered the united states within the August 2023 to perform individual services in the U.S. workplace of an overseas workplace. Ted spent some time working in the You.S. workplace up until December twenty-five, 2023, but didn’t get off the united states until January eleven, 2024.

Recent Comments